We're Almost Ready…

"Over the next several months we'll be giving early access to the next generation of progressive financial technology…

Register now and be one of the first to experience what it's like to have your own personal CFO for as little as FREE!. No credit card required.

Why Robo Advisor™ rocks!

We'll help you put together a strong financial plan & gain control of your finances…

We can help you determine your investment goals, the best investments available to fit your goals and assist you in meeting your objectives as market conditions & personal needs change.

Set Financial Goals

Identifying your financial goals is critical in developing a financial plan. Determine your short-term, mid-term and long-term goals, and we'll keep you informed if you get off track.

Create a Formal Budget

If you haven’t done so already, we can help by downloading account transactions as well as historical income deposits to estimate what your current expenditures are.

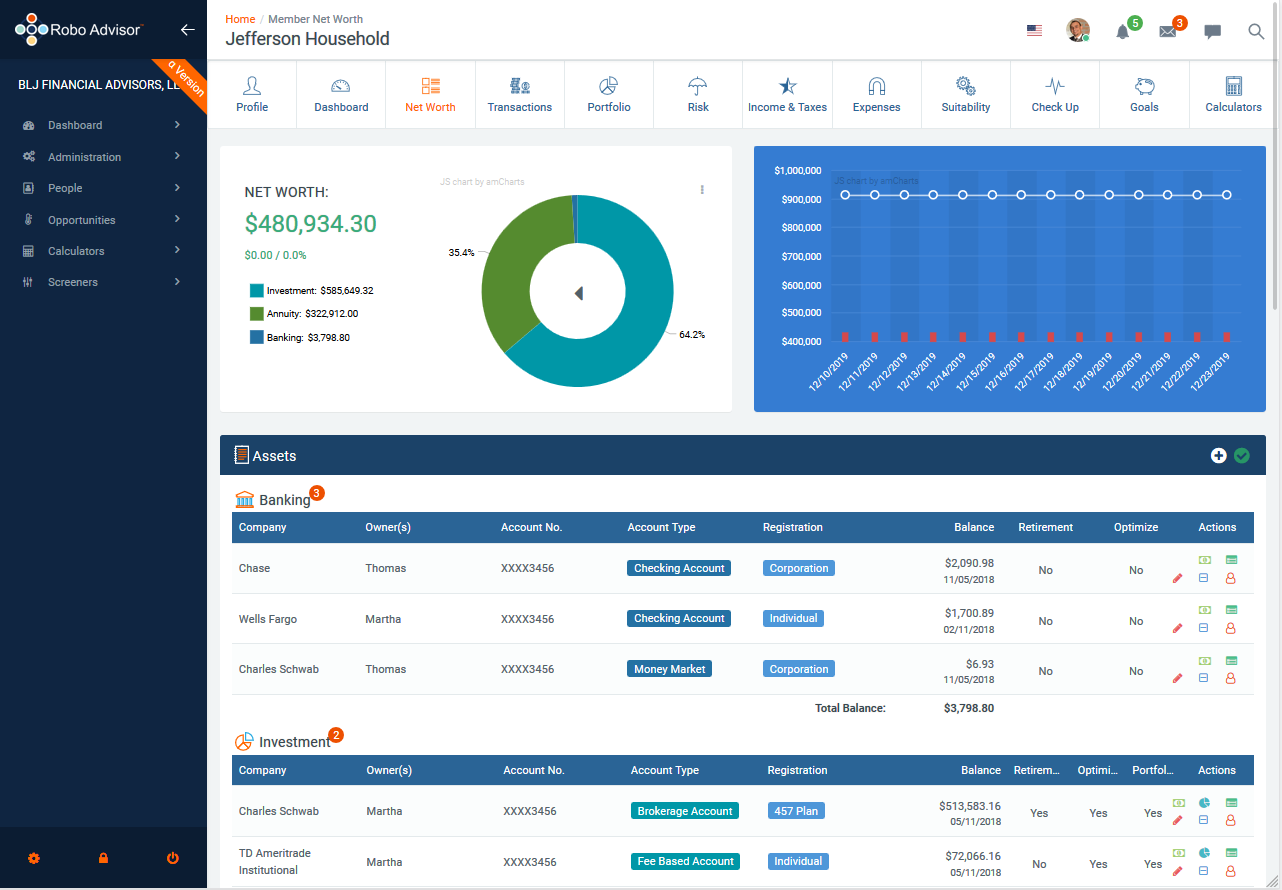

Inventory Your Assets

Register your accounts and have a detailed list of your assets, including bank and brokerage accounts, stocks and bonds, retirement plans and IRAs. We can estimate the value of your home and business interests as well.

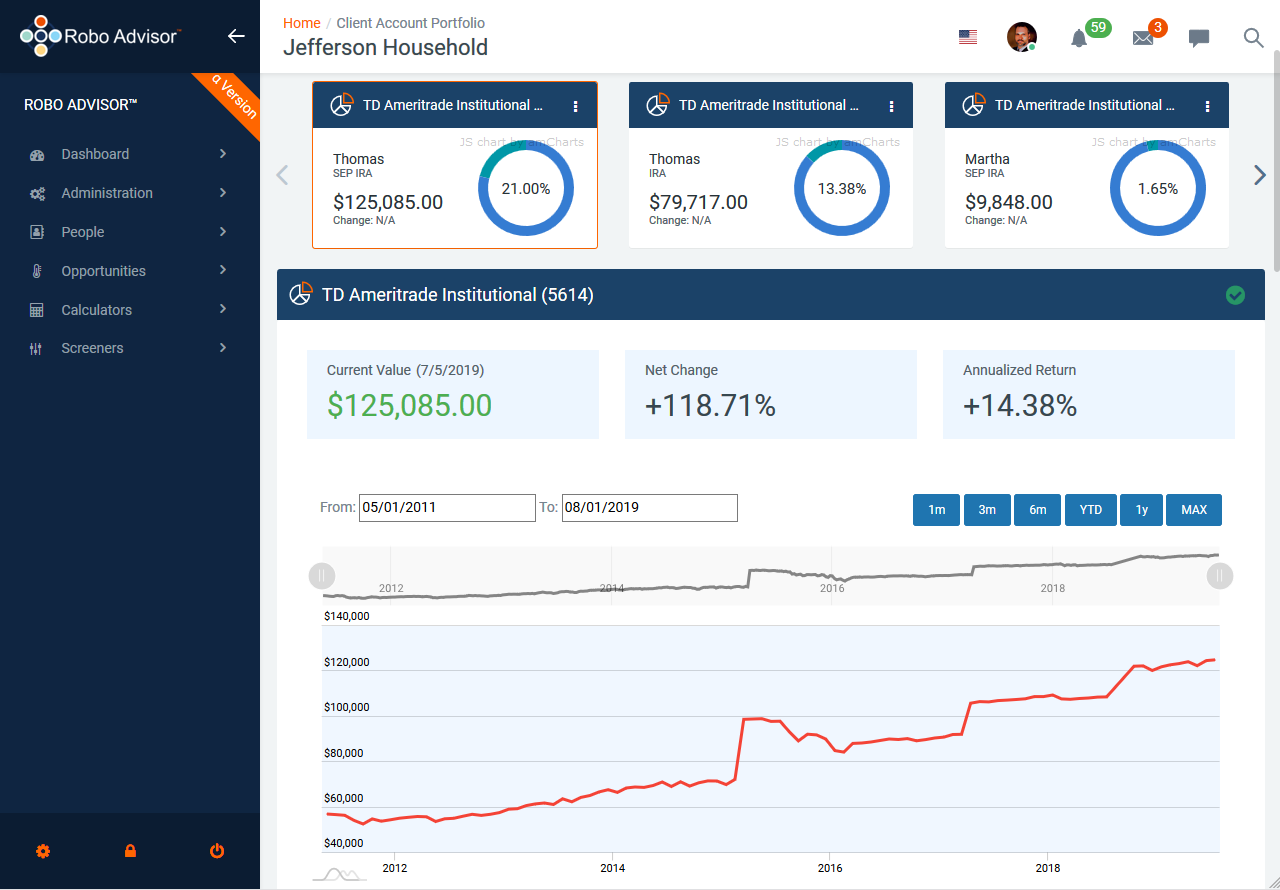

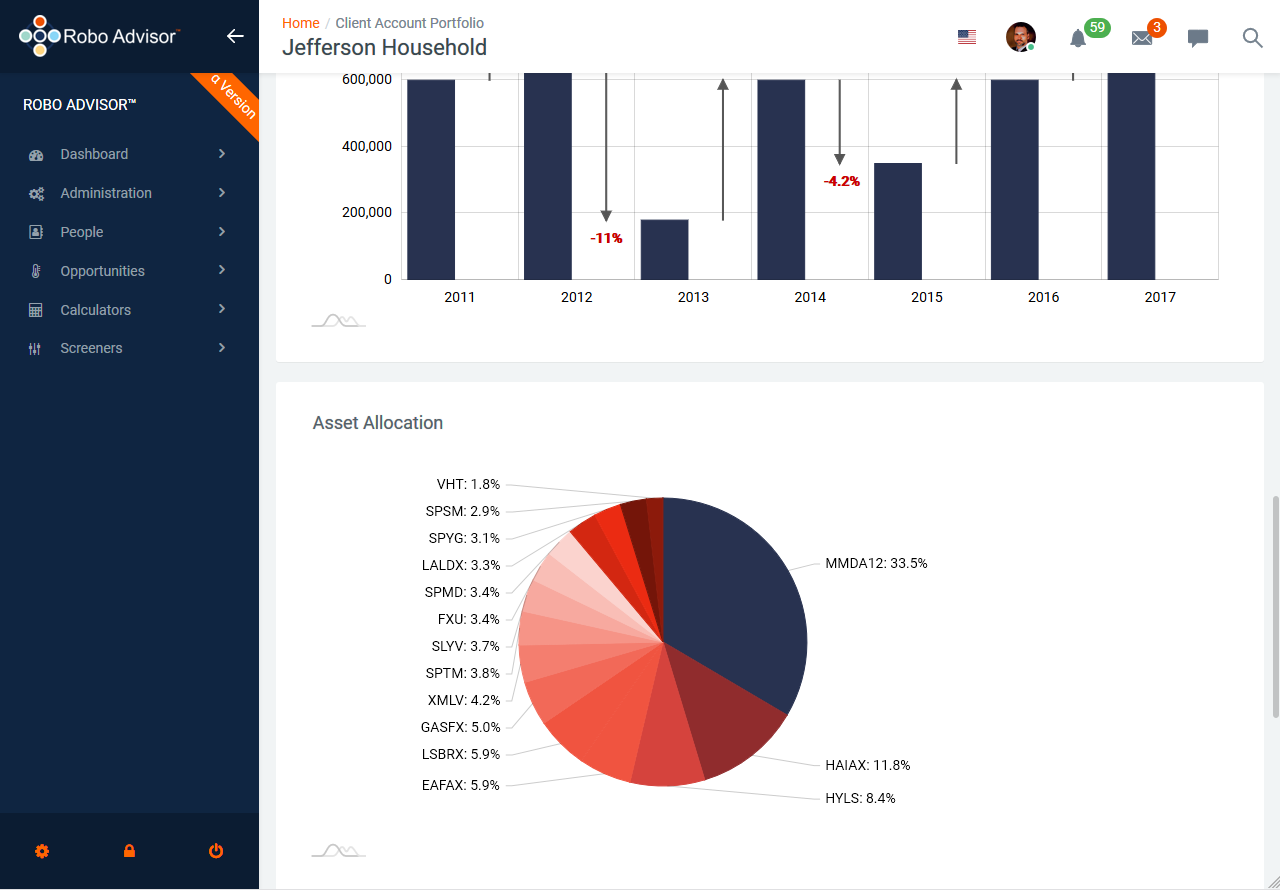

Review Your Investment Strategy

We'll automatically review your investment mix on a daily basis and let your know if you’re appropriately positioned to meet your goals, if not - we'll take steps to get you back on track.

It takes a village, or just one Robo Advisor™

Robo Advisor™ never stops gathering financial intelligence. It can make sure you always have answers to the questions you need, and the advice you deserve to help make the most of your money…

- What is my income?

- What are my taxes?

- What are my expenses?

- How much is left over?

- What should I do with it?

- Checking & savings balances?

- How much interest am I earning?

- My total credit card balance?

- What is my available credit?

- Can I lower my interest rate?

- What is my net worth?

- How are my investments doing?

- Do I have good investments?

- Do I need to make any changes?

- Are my investments expensive?

- Am I saving enough?

- At what age can I retire?

- Will I have enough income?

- Will I reach my financial goals?

- The market dropped, now what?

So if you're thinking about making life more simple…

We were thinking the exact same thing

Set financial goals, create a formal budget, inventory all your assets, review your investment strategy, monitor your progress, and investment in a low-cost, responsible manner for as low as FREE!

We have a way…

We were built for this

Our solution was built to manage your world of finance as well as the world you dare to become in a single environment, with a single password and around-the-clock access…

We have the tools to help you. After we complete the data-gathering questionnaire and have identified your goals, you will receive a customized asset allocation. Once your new account is opened, you can login to Robo Advisor InSight™ and add your other accounts so they can be part of a unified experience. Now each day, we can measure your progress against those goals and let you know if changes should be made.

Compile and maintain a detailed record…

"Our application can update your account information each day from more than 14,000 available financial institutions

Robo Advisor InSight™ makes it easy to gain control of your finances. You can have one password to track your banking, investment, and retirement assets. And also include debts such as credit cards, loans, mortgages, and lines of credit.

Life can get a little bit out of control…

Robo Advisor™ is personal financial management

Technology has given us on-demand access to nearly every type of account we have. The question is…how can you possibly have enough time to properly keep track and make sense of it all?

Financial independence is achieved by taking the time to develop a strategy. How you earn and spend money, the way you save and pay taxes, and ultimately how you invest your money all play a role in how you meet your financial objectives for the future. With so much to do, it might take a team of advisors to help maintain control of your finances. Since most folks don't have a team, I set out to find a better way. - jeffrey j. hovermale, Founder & CEO

What we'll do

We'll help to improve your overall finances and provide greater peace-of-mind.

We are dedicated to providing you with the best experience possible. Read below to find out why the sky's the limit when using roboadvisor.com.

Create Guaranteed Income

Planning for the future begins with planning for income. Once you have that problem solved, the desire to take risk diminishes significantly.

Low-cost Investing

We'll focus on low-cost investing as long as it makes sense. We still believe with all things being equal, performance trumps cost every time.

Provide Liquidity

Maintining a strategic position for emergencies and opportunities is a foundational principle within our investment philosophy.

Have a look at our

Client Opinions & Reviews

Things We Monitor At Robo Advisor™

Latest Articles

Trouble in candy land: How Peeps, pensions and a lawsuit…

Many of these multi-employer pensions are on track to run out of money. If the pension runs out of money, retired workers might only get a small percent of the money they thought they had earned…

By The Washington Post 3/30/2018No Pension? You Can 'Pensionize' Your Savings

After years of working, many people face the challenge of converting their savings into a sustainable flow of income in retirement. Some researchers think they have a practical solution…

By The New York Times 3/12/2018This Is What Life Without Retirement Savings Looks Like

Many people reaching retirement age don’t have the pensions that lots of workers in previous generations did, and often have not put enough money into their 401(k)s to live off of…

By The Atlantic 2/22/2018Subscribe to be notified...

Complete the information below and we'll put you on our "early access" list and notify you immediately as soon as we are cleared for launch.

Please accept Terms and Conditions.